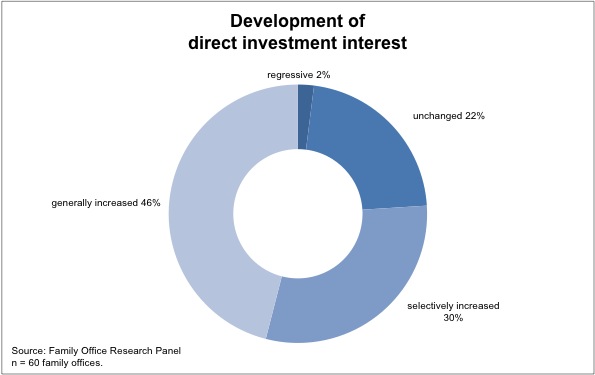

STUTTGART, GERMANY. Prof. Dr. Brückner conducts research on investment strategies of entrepreneurial families and family offices via the Family Office Panel, a research center specifically established for such investigations. In the most recent edition of her research series, “Family Office of the Future”, she examines changes in how investments are carried out. The result: direct investment and individual engagement are recognizably forced – even though they are accompanied by considerable challenges.

The financial strategies of highly affluent people are showing a clear trend: out of the complexity of framework conditions arises the rational demand of risk transparency and structural efficiency of assets, in addition to the emotional necessity to “understand” investment objects in their price dynamic, as well as in the best sense of their tangibility. Considering these arguments, tangible assets of all kinds are endowed with strategic relevance.

This development is especially pronounced for asset classes that, based on active, professional treatment, exemplify a significant potential value increase: apart from real estate, which is being acquired increasingly in professional portfolio approaches, this naturally holds true for entrepreneurial direct shareholdings as well as agricultural and forestry investments.

The appeal of these asset classes experiences an additional rise when individual expertise and networks are brought in to increase value as part of Buy-and-Build strategies. But direct investments in material assets offer additional benefits that transcend these starting points – as binding resources, for example, these material assets can only be liquidated by incurring significant transaction costs, which fosters discipline and acting with caution before investing.

This dynamic is particularly evident in “young” stakeholders in the first or second generation. Here, the crisis of maturing one’s risk competence more and more frequently leads to strategic modifications, which manifest themselves as an increased focus on fundamental value creation and direct investment.

This trend exhibits a particular challenge in that the professional implementation of illiquid entrepreneurial direct investments necessitates an extensive spectrum of specific competencies, which range from market access to execution to active treatment. With respect to Family Offices, this challenge is not always entirely met.

On the contrary, to date the majority of shareholders rather concentrates internal expert competencies on other areas, so that the accumulation of individual expertise with respect to these assets has yet to be decided upon. A well-founded decision naturally supposes a careful evaluation of the resources at hand.

With respect to the decision process to “Make or Buy”, there arise numerous solutions that connect a focused internal core competence spectrum of the operating Family Office unit, which can continue to remain apart from the direct investment field, with the selective access to external key personnel. In so doing, the segment demonstrates particular interest in peer networks, which provide specific market access and the possibility to benefit from partners’ know-how, while simultaneously offering up one’s own resources to other families in a way that maximizes capacity utilization.

Possibilities for cooperation with other families with respect to direct investments thus experience more and more attention, with equally minded families increasingly joining together in so-called Club Deals to collectively carry out specific investments.

Investing via Club Deals offers the involved parties, apart from decreased lot sizes, transparency and access to the comparative advantages of their partners in the sense of access to markets and expertise, which in the case of individual investments would otherwise remain mostly inaccessible to the single families. For Family Offices, access of this sort is termed the central motive for investing as a Club. However, Club Deals are not equally suited for all families; they require a systematic, basic requisite from all parties to accept the limitations of their individual influence.

A further challenge lies in the identification of suitable partners, both on a personal as well as a professional level, since the networks of families are frequently limited in terms of size and territorial reach. Enormous surpluses could be offered by the creation of an efficient platform exclusively accessible for families and their Family Offices. Such a platform could guarantee the personalized consolidation of investment clubs on the basis of defined investment interests, competence levels and additional requisites demanded of partners via an efficient concept. This way, the previously drawn-out and accidentally successful Matching process would be significantly improved.

In an ideal case, by means of the more efficient Matching process and the resulting, significant reduction in transaction costs, compared, for example, to those arising from recurring to intermediaries, direct investments would become even more attractive. This topic, including a set of practical goals, is the focus of the research and networking initiative of the “Family Office Panel”, starting in 2014.

Translation from German into English by ROOSTERGNN.