A quick two weeks have passed since the initial flutter of the stock markets in the U.S. Since then, we have gone through the usual stages of round the clock news coverage, panic and quickly getting distracted by something the President said or tweeted. Before we could react to the news or fully understand it, the world around us has already moved onto something else in the pecking order.

When the news initially broke, I couldn’t help but ask myself: how does this reflect on the policies that have been pushed through by the administration by the current and previous President? Especially, since the markets have reacted in an overwhelmingly positive way since the news of Trump’s win.

As an outsider, I thought it might be interesting to put together, what might be some positive lessons to take away from the recent market tumble and shed more light on them. Hopefully, they will give us some grounds for understanding what might or might not work in the current economic climate.

The market correction that everyone knew was coming

As mentioned earlier, given the rate at which the markets were surging since the elections, a sharp fall was to be expected. “You had a market that was overbought and ripe for something to undermine its tranquility,” said Mark Luschini, chief investment strategist at Janney Capital.

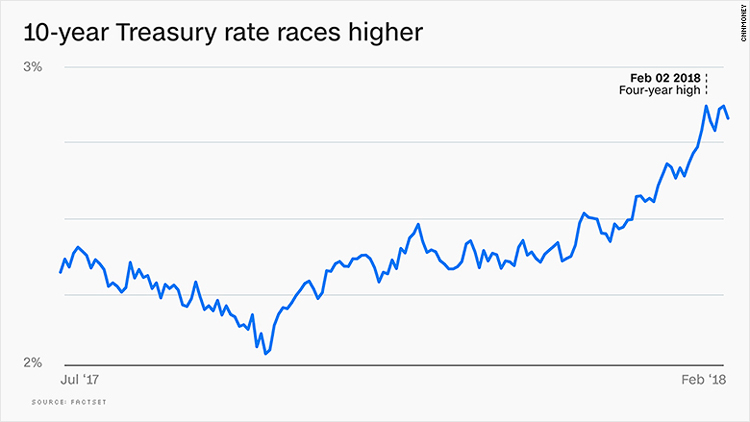

The yield on treasury bonds

Even after the drop in the market, the yield on Treasury bonds continued their uptick. Following the sharp sell-off on February 5th, 2018, the yield continued its climb from 2.4% to 2.8%. The combined effect of better economic prospects, along with tax cuts, have led to the increase in demand for bonds as a viable option. Funnily enough, bond yields dropped again within a quick span of few days after the market drop.

Treasury rate | Factset, NYTimes Images

Talk of change in interest rates

For years the interest rates have been at a steady low. But this is going to change soon. With positive job reports, low unemployment, increasing wages, the Fed is expected to hike the interest rates in the coming months. Earlier, in the year when the Central Bank suggested hiking interest rates, the markets were skeptical because inflation has been subdued for such a long time. But now with faster pay gains for workers, the Fed has to make changes soon.

4.1% unemployment pate

The jobs report released by the Labour Department in January boasted 200,000 more jobs added in the last month. Of course, there is plenty of statistical error built into those numbers, and they may turn out to be incorrect. The more important take away, however, is that wage inflation is finally here. Which gives the Fed another reason to hike interest rates to counter the risks of inflation in a timely fashion.

Wage inflation

This is where the economic policymakers and the stock traders share different views. While one may think wage inflation is a positive sign for the economy, traders think otherwise. One of the contributing factors to the recent dip was the release of the average hourly earning that recorded a 2.9% in the last year. This was the largest gain since the great recession. Even the most dovish member of the Federal Reserve, Neel Kashkari, responded saying the rise in average hourly earnings “was one of the first signs that we’re seeing wage growth finally starting to pick up”.

Inflation | ritvitcarvalho

Last but not least

How is the new Fed Chair, Jerome Powell, going to handle these new dynamics? He is already being tested by the markets in his first month. Is he going to continue the gradual approach adopted by his predecessor? Or will he be more hawkish? Will we see a return to a more volatile market or will the Fed err on the side of caution? All these factors make for a very interesting year ahead for the U.S. economy.

What do these positives say about the current president and his economic policy? Or is he benefiting from the work done by his predecessor? Trump has been quick to take credit for the market gains ever since he took office. A quick glance at his Twitter feed tells us he has tweeted every few days congratulating himself on the surging market. Only to make a quick U-turn and barely taking any responsibility for the last week. Maybe, the only negative is this scenario is the poor leadership skills displayed by the President. His erratic approach and self-gratifying nature might have a bigger impact on the economy than any of us can predict.