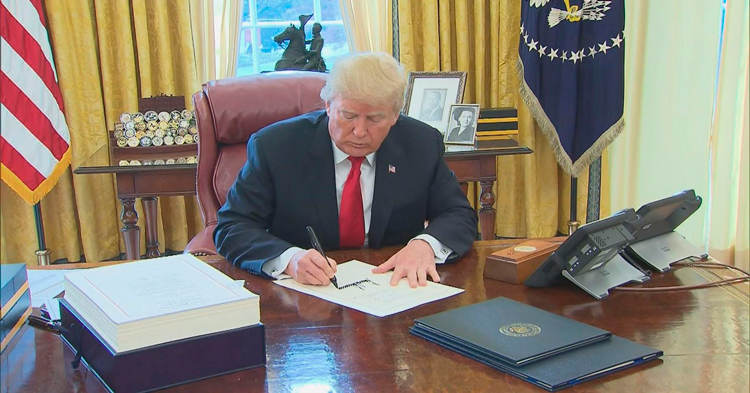

The Tax Cuts and Jobs Act signed by Donald Trump in December 22’ 2017 is a sweeping overhaul of the US tax system. The tax cut package has been presented as a big, beautiful ‘Christmas present’ to the middle-class, in conformance to the ‘America First’ agenda and the ‘Main Street not Wall Street’ policy promise by the Trump Govt.

Prima facie, it seems that Trump has played Santa Claus to the middle class after all. The major changes are:

- The Act lowers tax rates within the seven slab structure.

The old tax rates were: 10% 15% 25% 28% 33% 33-35% 39.6%

The new tax rates are: 10% 12% 22% 24% 33%, 35% 37%

People from almost all tax brackets benefit from the change except those in the erstwhile 33-35 % tax bracket who are pushed up to 35%.

- The bill doubles standard deduction (a flat deduction from gross income to cover necessary expenses). A single filer’s standard deduction now increases from $6,350 to $12,000 while for married and joint filers the deduction increases from $12,700 to $24,000 and for Heads of households the deduction goes up to $18000 up from $9550.

- The bill increases the Child Tax credit from $1,000 to $2,000 and provides $500 credit for non-child dependents.

- It allows for a higher claim for medical and dental expenses for years 2017 and 2018 by about 2.5% of Adjusted Gross income.

Wow! Looks great but wait….The party is not for long and the host Trump wants the guests out early:

The individual tax rate changes are scheduled to expire within eight years reversing all tax benefits by 2025!

The increased Standard Deduction comes at a cost. The Act eliminates the earlier personal exemption of $4050 per person which used to benefit the poor with large families. e.g. In case of a family of four, if their standard deduction is $12,700 and they’re able to deduct over $16,200 (4050*4) in personal exemptions, that’s $28,900 as against the proposed $24000 standard deduction. There’s no gain for them.

- Itemized deductions for claiming casualty and theft losses, unreimbursed job expenses, moving expenses, regulatory fees, tax preparation expenses etc have been repealed.

- Alimony payments are no longer deductible after 2019 which indirectly means less spousal support to divorced women.

- Home equity loans will no longer enjoy an interest deduction. This will deprive cash strapped families an avenue of taking advantage of the value of their properties to get a second mortgage.

- The capping of state and local taxes (SALT) deductions at $10000 will affect more than 40 million households. The SALT deduction is the main reason why people used to itemize deductions instead of claiming a fixed standard deduction. SALT deductions made sense even for state governments as they were able to raise state taxes without much resistance as taxpayers used to get much of the hike refunded back to them in federal taxes. Interestingly high income states like New York, New Jersey, California and Connecticut that are going to be hit by this provision are also strongholds of the Democratic Party.

- Individuals in the highest tax brackets see a windfall with lower tax rate- 37%, compared to 39.5% before. This is against the basic tenet of taxation-higher taxes on higher earnings.

High net worth individuals benefit from the tax-exempt college educational plans now extended to private K-12 education.

They also benefit from estate tax exemption which doubles and now will be levied only on estates with assets over $11.2 million letting individuals belonging to the Trump tribe pass even more millions of dollars to their heirs.

- One of the bill’s most damaging provisions with far reaching consequences is the repealing of the requirement of the erstwhile Affordable Care Act (Obamacare), that all Americans need to compulsorily buy health insurance. Obamacare was imperfect yes, but sought to cover the needy with basic medical insurance. Its repeal could leave 13 million Americans uninsured and vulnerable to medical emergencies. Another casualty of this new move is that with the insured numbers being reduced, premiums for millions of others who avail insurance would increase.

The benefits to individuals are only in the form of sops, the real gravy has been reserved for companies:

- The bill slashes the maximum corporate tax rate from 35 percent to just 21 percent and what’s more the cuts are permanent and not reversible as in the case of individual tax rates.

- It allows businesses to claim deduction in case of newly purchased assets at one go instead of amortizing them over several years.

- The bill eliminates the corporate Alternative Minimum Tax or AMT. (Compulsory minimum tax to be paid if tax credits result in a tax rate lower than 20%). Thus companies can now get away with paying low/negligible taxes by showing ‘ R&D expenditure, welfare expenditure, backward areas investment’ etc to obtain tax credit.

- The tax bill shifts from a world tax system to a territorial tax system in which companies pay tax only on their domestic profits and is a windfall for multinationals in the long run. The current proposal of a one-time low repatriation tax of 15.5%/8% on profits parked overseas in effect rewards rather than penalizes companies that have stockpiled profits abroad and will generate a spike in revenue for the Govt. only in the current year.

What’s scary is that the bill is flawed on its most fundamental premise—that the bill would pay for itself. i.e. Growth and job creation would be fuelled to such an extent that the tax cuts would offset revenue losses. But it won’t. Given the corporate mind set, corporations that are flush with cash profit, will use it to buy back shares, pay more dividends to shareholders, or perhaps grant small bonuses and not hire more employees.

The bill is a feast for the federal deficit monster who lies in wait; with glee and growing fatter by the day. Most economic forecasts predict that the new tax bill will increase GDP only marginally—by just 1.7% in the long-term while, the federal deficit will climb by nearly $1.5 trillion over the next decade !.This will trigger spending cuts in case of Medicare and Medicaid which would be disastrous for low income Americans. There’s also the worry that the bill’s impact on the deficit will prompt the Federal Reserve to hike interest rates making loans and credit more expensive in the coming years. What’s worse is that it will be in these very trying times ahead that the earlier lower tax benefits will reverse and the poor will be devoid of insurance.

Trumps’ claim of ‘It’s the Main Street…. not Wall Street’ rings hollow. It has been Wall Street all along….. and all the way ahead too. With control of both houses of Congress and the White House for the first time since 2005, Republicans have seized their moment and the nation’s jugular as well.

Tax cuts, they bring ‘em big bucks,

Not for the masses but their bosses.

But what about revenue losses?

Oh! leave the worrying to those Dem’ asses.

https://www.investopedia.com/news/trumps-tax-reform-what-can-be-done/

https://www.vox.com/2017/12/19/16791936/repatriation-holiday-republican-tax-bill-explained