Martin Shrkeli, an American CEO who bought the rights to an anti-parasitic infection and jacked up its price by 5500%, continues to make news as he is acquiring another pharmaceutical company for pennies on the dollar in the hopes of profiting of future sales of a not yet FDA approved antibody treatment.

Mr. Shrkeli´s activities attracted the media´s attentions back in September, when he became CEO of Turing Pharmaceutics and increased the price of a 62 year-old drug named Daraprim from $ 13,50 to $750 per pill. Daraprim is a so-called orphan drug because it was created for the treatment of a very specific medical condition and there is no real alternative to it. It is meant to cure a parasitic infection called taxoplasmosis in people with weak or compromised immune systems such as cancer and AIDS patients, pregnant women and children.

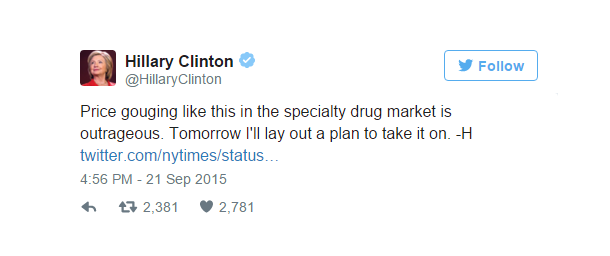

The internet community reacted very negatively to the story, putting him on blast on social media and accusing him of profiting off of the patients´ health. Many public figures attacked him on twitter and in public, including presidential candidates such as Donald Trump, Bernie Sanders and Hilary Clinton, who promised a plan to tackle the problem of price gouging in the pharmaceutical industry once elected.

The news became quickly a scandal and new aspects of the story came out, including the fact that Mr. Shrkeli was fired as CEO of his previous company Retrophin for allegedly using company shares to pay back the investors of a hedge fund that he dissolved in 2011 after a disastrous investment that costed him $7 million. Retrophin is currently suing him for $65 milion for corporate looting, fraud and stalking, accusing him of using a series of “extra-legal maneuvers” including threats to former employees, settling of personal debts and rewards to his friends.

In a further development, Slate.com broke the story that Martin Shkreli had already practiced this method of price gouging before, when in 2014 he bought the rights to Thiola, a “decades-old” kidney medication and raised the price from $1 to $30 per pill, a 2000% increase. Also in this case the treatment is the only one on the market to battle a rare disease which effects only about 20 000 people in the US. The condition is called cystinuria and it causes subjects to constantly develop extremely painful kidney stones. Patients are typically diagnosed as children and may need to take up to 8 pills a day to keep the disease under control.

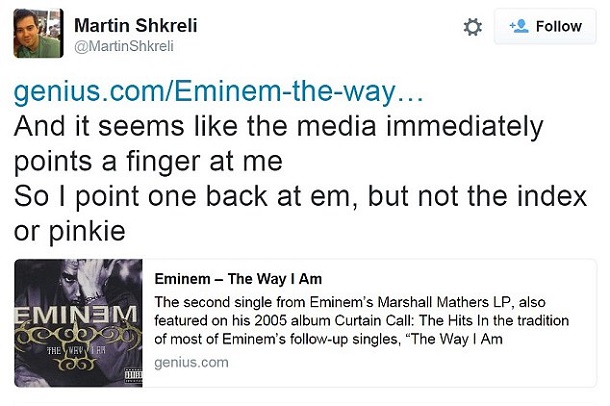

Mr. Shkreli tried to fight back against this public exposure, claiming that his intentions were to re-invest the profits into R&D in order to create a better drug. He released a series of interviews and bizarre tweets, which included lyrics from Eminem and Wu Tan Clan songs, to defend his point of view. He also tried to address presidential candidate Bernie Sanders more directly by making a campaign contribution for his run and asking for a private meeting to discuss with him how pricing in the pharmaceutical world works. Mr. Sanders publicly denied him the conversation and rejected his donation by giving the money to a charity that helps HIV and AIDS patients in the LGBT community.

Moreover many experts have criticized his claim that the increase in price is justified by the development of a new drug, saying they don´t believe that the current treatment is ineffective and that it should be replaced. In the end Turing pharmaceutics caved in to media pressure and announced that the cost of the drug will be lowered, even though as of today no action has been taken to this effect.

In October Imprimis Pharmaceuticals launched a new drug based on the same core compound as Daraprim, and is selling the treatment for $0.99 per pill. As a result, Turing Pharmaceuticals has lost more than $15 milion in the last quarter. The so-called “most hated man on the internet” has now proceeded to buying a third pharmaceutical company called KaloBios Pharmaceuticals Inc., a publicly traded company developing several antibody medication for cancer patients, none of which has been approved yet by the FDA. The company was on the verge of bankruptcy when Mr. Shkreli and his associates decided to buy 70% of its shares thereby increasing their market value by 400%.

Now Mr. Shkreli is both CEO and chairman of the board, together with three more board members. The goal of this operation seems to be looking for new sources of financing to complete the necessary testing for FDA approval. Once it passes the FDA, the drug could have enormous commercial appeal not necessarily because of its market share but rather because the company has a lot of power when it comes to establishing the price of new drugs, especially when there are no competitors and when the patients need them for their survival.

The story has sparked a public debate on the role of regulations on the free market, since many view the lack of rules in a sector where people´s lives are at stake as concerning. As a matter of fact, the same drug is sold in other countries where regulations on the market are tighter; for example in the UK the same treatment is priced at less than £ 0.60 per pill. Public opinion in the US seems to be finally united by this story, as both the left and the rightwing are slowly moving away from the idea that there is nothing to be done in terms of regulating financial operations both inside and outside of Wall Street.